Stock market performance

Stock markets and Viscofan's performance

In the 2024 financial year, global GDP growth was 3.2% and is expected to be 3.3% in 2025 and 2026, according to the forecasts of the International Monetary Fund, rates that are below the historical average of 3.7% (2000-2019).

A year in which the backdrop continues to be marked by war and geopolitical tensions, the process of moderation in inflation, although with some resilience in food prices, the relaxation of the monetary policies of the main central banks with decreases in interest rates and the effect of the disruption of artificial intelligence on the economy and stock markets.

An economic situation that is leading to divergent performance in the main regions. In the United States, growth in the second half of the year stands out, driven by strong consumer spending on the back of rising household disposable income, in a context of less restrictive monetary policy and favourable financial conditions. In addition, in China the situation is impacted by the slowdown in domestic consumption amid the stabilisation of the real estate market. In Europe the situation remains weak, weighed down by the slowdown in industrial activity, an environment of political uncertainty, despite the recovery of consumer spending after the improvement in real incomes.

In exchange rates, noteworthy was the appreciation of the US dollar against the euro in the closing months of the year driven by the political change in the United States, expectations of new tariffs and higher interest rates.

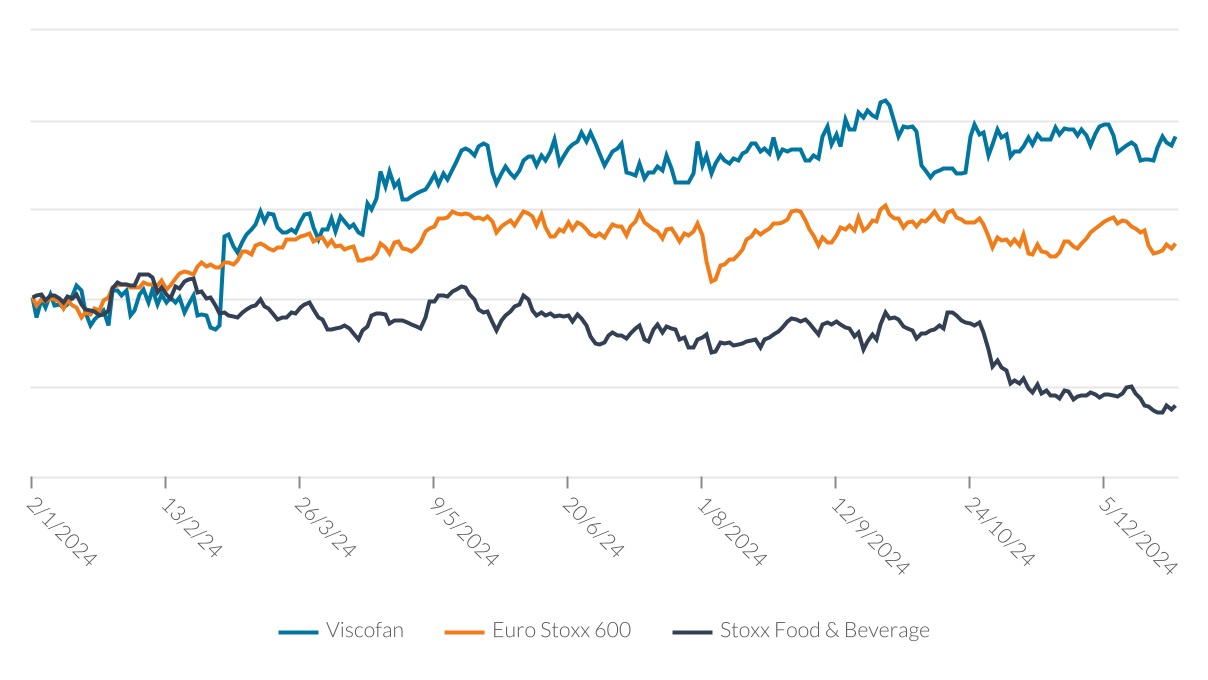

The lower interest rate environment has favoured the main stock market indices, which have closed the year with gains. In the United States, the S&P 500 index gained 23.3% in 2024, and in Europe the Euro Stoxx 600 gained 6.0%, the German DAX gained 18.8%, and in Spain the Ibex 35 gained 14.8%.

In contrast, the food sector, of which Viscofan is a member in Europe (Euro Stoxx Food and Beverage), has fallen by 12.3%, partly impacted by persistent food price inflation, while the year saw the drawing to a close of the inventory adjustment process seen in the previous year.

In this context, global demand for casings has recovered and Viscofan, as the market leader, has capitalised on this situation in a year characterised by improved operating profitability and higher cash generation. Hence, Viscofan closed the year at €61.00 per share, an increase of +13.8% and +19.5% if the dividends paid in the year are taken into account.

The average daily market price in the year was €59.34 per share and Viscofan's market capitalisation stood at €2,837 million at the end of 2024.

In addition, 10.3 million Viscofan shares were traded on the Spanish continuous market during the year, with cash traded of €612 million, equivalent to a daily average of €2.4 million.

[1] World Economic Outlook Update Report published in January 2025

Euro Stoxx600, Stoxx Food & Beverage and Viscofan in 2024

*Graph on a baseline of 100 since 29 December 2023

*Graph on a baseline of 100 since 29 December 2023

Viscofan shares

Viscofan's share capital consisted of 46,500,000 shares of €0.70 par value each, of the same class and fully paid-in.

Viscofan's shares are admitted to trading on the Spanish stock markets, listed on the continuous market, since the company's exit from the stock market in December 1986.

It is listed on the Madrid Stock Exchange General Index (IGBM) and forms part of the Consumer Goods segment, within the Food subsector, the Ibex Mid Cap and at European level to the Euro Stoxx Food and Beverage index and the Stoxx Europe 600 index.

Also, Viscofan is part of the IBEX ESG, created by the BME (Spanish Stock Exchanges and Markets) to promote sustainability.

Dividend

Throughout the different strategic plans, the Viscofan Group has built a sound and flexible business model. This characteristic entails the creation of cash flows that allow investment projects to be carried out in order to improve value creation, which is shared with shareholders in cash and at the same time maintaining a sound balance sheet structure.

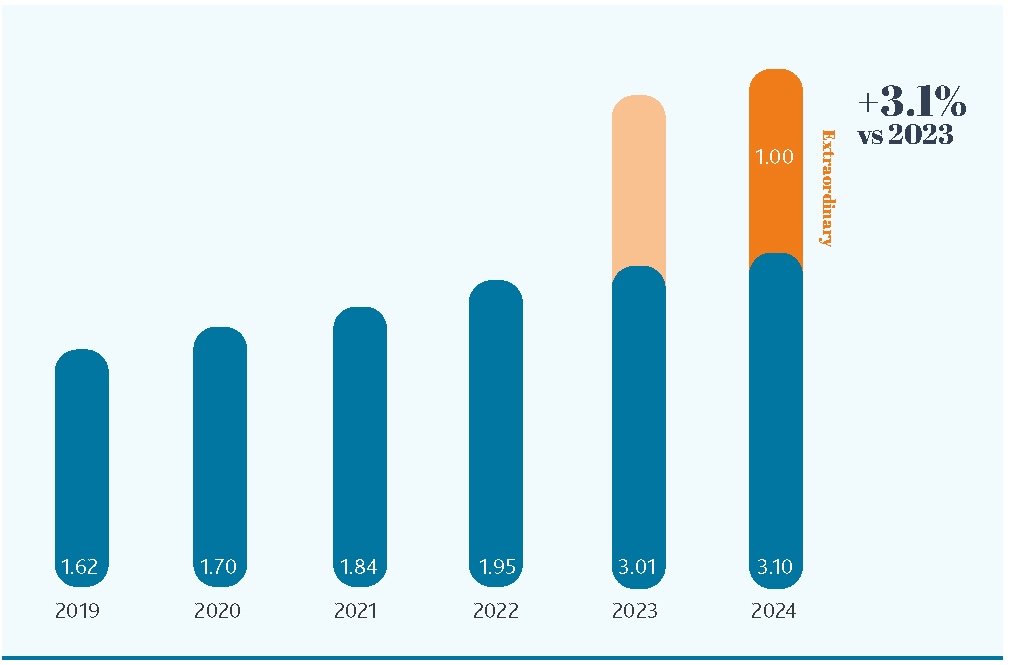

Accordingly, the Board of Directors of the Viscofan Group has resolved to propose to the General Shareholders' Meeting a profit distribution equivalent to a remuneration of €3.10 per share. Of which, €2.10 per share - equivalent to the distribution of 62% of net profit attributed to the controlling entity- is of an ordinary nature, and €1.00 per share is of an extraordinary nature arising from the generation of operating cash flows that were higher than envisaged in the Beyond25 strategic plan.

In this way, shareholder remuneration consists of:

- An interim dividend of €1,437 per share (paid on 19 December, 2024).

- The proposed ordinary final dividend of €0,653 per share and extraordinary final dividend of €1.00 per share under the optional dividend system in cash or shares "Viscofan Flexible Remuneration" in a lump sum payment expected in June 2025.

- A bonus of €0.01 per share for attending the General Shareholders’ Meeting.

The proposed total and ordinary distribution is 3.1% higher than the previous year's total remuneration of €3.01 per share, and 4.7% higher than the proposed ordinary distribution of the previous year.

In turn, the Board of Directors has approved submitting to the General Shareholders' Meeting the possibility of flexible remuneration with which shareholders can decide whether they prefer to obtain new shares in a paid-up capital increase or cash remuneration.

Furthermore, in order to avoid dilution of shareholders who do not participate in the capital increase, the Board plans to redeem the treasury shares necessary to keep the number of outstanding shares stable.

The trend in dividend per share in recent years is as follows

Viscofan, its shareholders and investors

One of Viscofan’s objectives, through its Department of Investor and Shareholder Relations, Communication and Sustainability is to create value for the investor community by improving accessibility, the transparency of information and providing shareholders with relevant information of a financial and non-financial nature, on its strategy and on its operations to gain a better understanding of the company.

To ensure this information flow and to grant certainty to shareholders, markets and other stakeholders on the transparency and access to information, Viscofan has a Communication policy with shareholders, institutional investors, advisors on voting and economic-financial, non-financial and corporate information, defined in conformity with the good governance practices and recommendations applicable to listed companies.

Communication channels

Viscofan provides the investment community with a multitude of communication channels: presentations at seminars and events organised by the financial community, roadshows with institutional investors promoted by the company or by brokers, earnings presentations, the General Shareholders’ Meeting, organised visits to Viscofan’s head office, telephone calls to a dedicated investor and shareholder helpline, a special e-mail address, notifications and regular public information submitted to the CNMV (Spanish National Securities Market Commission).

Also, the information published on the website www.viscofan.com:

- In the Investor Relations section in which Viscofan makes the latest news, reports and quarterly presentations of results, annual report, share price performance and other information of interest, etc., available to the public.

- The Sustainability section details information on Viscofan's main commitments to the Sustainable Development Goals, sustainability indicators and the 2030 commitments set out in the Group's Sustainability Action Plan.

- Viscofan's Corporate Governance section publishes the information relating to the Board of Directors, committees, policies and regulations and other related information of interest.

Viscofan also maintains fluid communication with the financial markets, so that at the end of 2024 a total of 15 analysis companies, both national and international, are covering the company.

Bidirectional communication is important, since the questions and concerns of the financial community are taken into account and transmitted within the company, such as financial, strategy, sustainability and corporate governance matters.

In 2024, the most frequently asked questions were related to the following: the recovery of casing demand and the completion of the inventory adjustment process; the evolution of co-generation electricity revenues and New Business; the acquisition of the companies Brasfibra and Master Couros in Brazil; the performance of operating profitability and raw material and energy prices; sustainability projects at Viscofan and shareholder remuneration, among others.

Key stock market data developments

| Period Beyond25 | Period MORE TO BE | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Share price € | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | ||

| Year-end price | 61.00 | 53.60 | 60.20 | 56.90 | 58.05 | 47.10 | 48.12 | 55.01 | 46.85 | ||

| Maximum in the year | 64.40 | 68.85 | 63.65 | 61.45 | 64.35 | 56.55 | 66.20 | 56.33 | 56.06 | ||

| Minimum in the year | 51.70 | 51.60 | 48.92 | 53.25 | 43.28 | 40.12 | 46.20 | 46.75 | 41.84 | ||

| Viscofan's performance on the continuous market | Year-end 2024 | Year-end 2023 | Year-end 2022 | Year-end 2021 | Year-end 2020 | Year-end 2019 | Year-end 2018 | Year-end 2017 | Year-end 2016 | ||

| % ann. change Viscofan | 13.8% | -11.0% | 5.8% | -2.0% | 23.2% | -2.1% | -12.5% | 17.4% | -15.8% | ||

| % annual change IGBM | 14.1% | 21.6% | -4.8% | 7.1% | -15.4% | 10.2% | -15.0% | 7.6% | -2.2% | ||

| % annual change IBEX 35 | 14.8% | 22.8% | -5.6% | 7.9% | -15.5% | 11.8% | -15.0% | 7.4% | -2.0% | ||

| % Annual Change Euro STOXX 600 | 6.0% | 12.7% | -12.9% | 22.2% | -4.0% | 23.2% | -13.2% | 7.7% | -1.2% | ||

| % Annual change IBEX Medium Cap | 11.7% | 5.9% | -7.4% | 8.6% | -9.7% | 8.4% | -13.7% | 4.0% | -6.6% | ||

| % annual change Food and Beverages IGBM sub-sector | 11.4% | -3.2% | -0.7% | -1.6% | 10.6% | 1.8% | -8.4% | 5.2% | -5.4% | ||

| Stock exchange trading data | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | ||

| Capitalisation at year-end (Mn €) | 2,836.5 | 2,492.4 | 2,799.3 | 2,645.9 | 2,699.3 | 2,190.2 | 2,242.6 | 2,563.7 | 2,183.4 | ||

| Continuous market traded cash (Mn €) | 611.6 | 663.0 | 763.3 | 1,135.8 | 1,561.8 | 1,230.5 | 1,669.1 | 1,995.2 | 2,707.1 | ||

| Average per session (€Mn) | 2.4 | 2.6 | 3.0 | 4.4 | 6.1 | 4.8 | 6.5 | 7.8 | 10.5 | ||

| Traded shares | 10,347,687 | 10,946,556 | 13,893,544 | 19,626,412 | 28,338,888 | 25,815,115 | 29,807,220 | 38,658,041 | 54,701,597 | ||

| Daily average of traded shares | 40,739 | 42,760 | 54,060 | 76,666 | 110,268 | 101,236 | 116,891 | 151,600 | 212,022 | ||

| Ratios per share | Year-end 2024 | Year-end 2023 | Year-end 2022 | Year-end 2021 | Year-end 2020 | Year-end 2019 | Year-end 2018 | Year-end 2017 | Year-end 2016 | ||

| Shares admitted to trading | 46,500,000 | 46,500,000 | 46,500,000 | 46,500,000 | 46,500,000 | 46,500,000 | 46,603,682 | 46,603,682 | 46,603,682 | ||

| Basic earnings per share (1) | 3.45 | 3.05 | 3.02 | 2.87 | 2.63 | 2.27 | 2.66 | 2.62 | 2.68 | ||

| Proposed ordinary remuneration per share (2) | 2.10 | 2.01 | 1.95 | 1.84 | 1.70 | 1.62 | 1.60 | 1.55 | 1.45 | ||